Short Selling: A Comprehensive Guide to Principles, Strategies, and Risks

What is shorting?

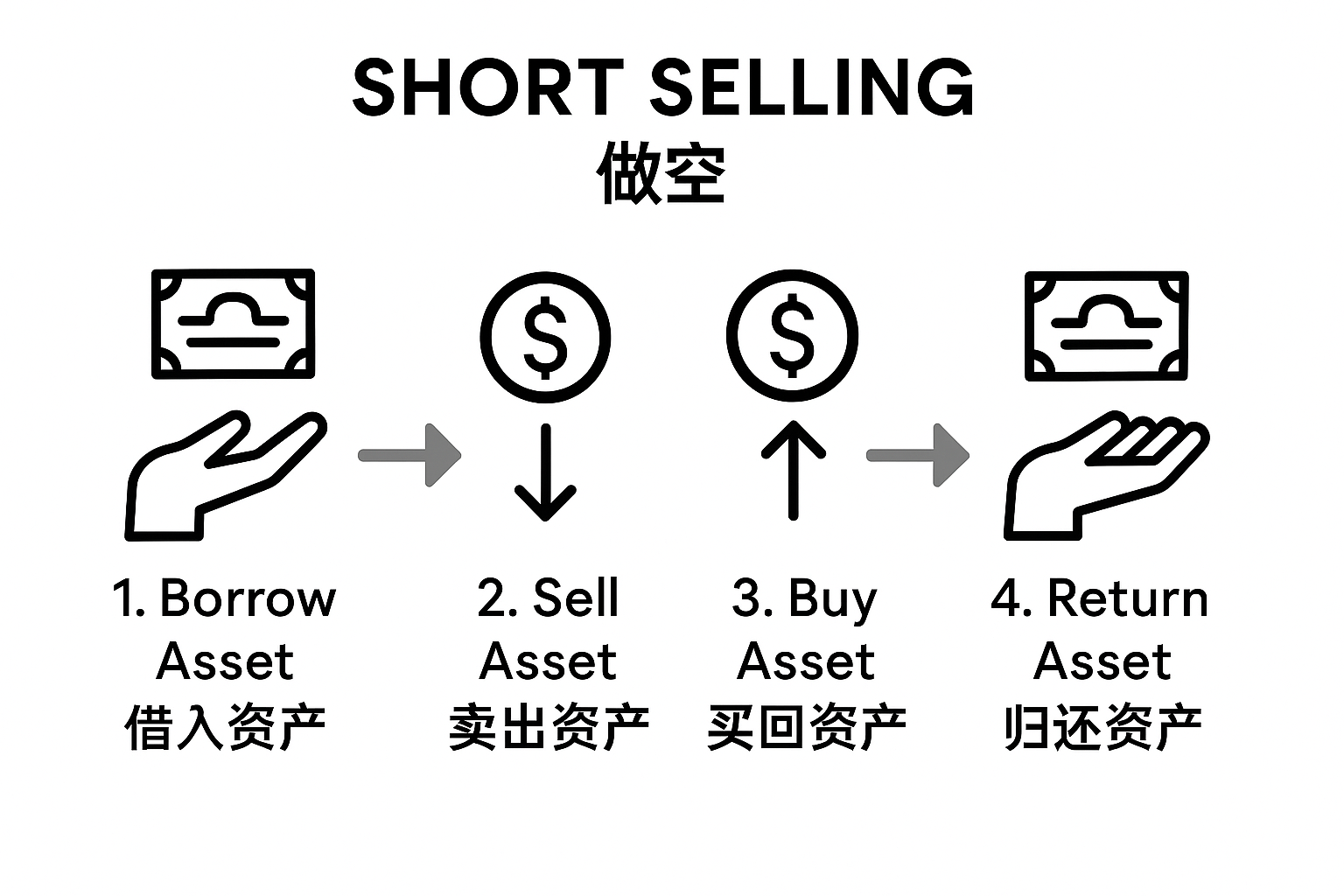

Shorting is a strategy where investors predict that the price of an asset will fall. They first borrow the asset and sell it, then buy it back after the price drops to return it, earning the difference. This method is the opposite of the traditional “buy first, sell later,” allowing investors to profit even when the market is declining.

The operation process of shorting

Shorting typically involves borrowing an asset, selling it, waiting for the price to drop, buying back the asset (closing the position), returning the asset, and settling the profit. For example, if you sell borrowed assets for $100 and then buy them back for $80, the profit would be $20 (minus related fees).

The main motivation for shorting

The reasons for investors to engage in shorting are diverse, including hedging against the downside risks of existing positions, purely speculative profits, and facilitating market price discovery. Shorting helps the market to more quickly reflect negative news and improve market efficiency.

Key Points for Choosing a Shorting Platform

Choosing a trading platform that supports shorting is crucial. Taking Gate as an example, this platform offers shorting services for various crypto assets, has a user-friendly interface, transparent trading fees, and boasts high security with flexible leverage options, making it suitable for both beginners and advanced users.

The risks and challenges of shorting

Shorting may have profit potential, but the risks are extremely high. The biggest risk lies in the theoretical possibility of unlimited losses; if asset prices continue to rise, investors must buy back at high prices, resulting in significant losses. Additionally, there are risks such as margin calls, forced liquidation, borrowing costs, and regulatory policies. Newcomers must be cautious, set stop-loss orders, and implement strict risk control.

Conclusion

Shorting is an important strategy for flexibly responding to market fluctuations. However, due to the higher risks involved, it is recommended that investors participate only after fully understanding the principles and risk control measures. Choosing the right platform and operating rationally are key to successfully shorting in the crypto market.