Kanye West Coin: Hype, Risks, and the Celebrity Token Dilemma

Crypto Experiments Driven by Celebrity Influence

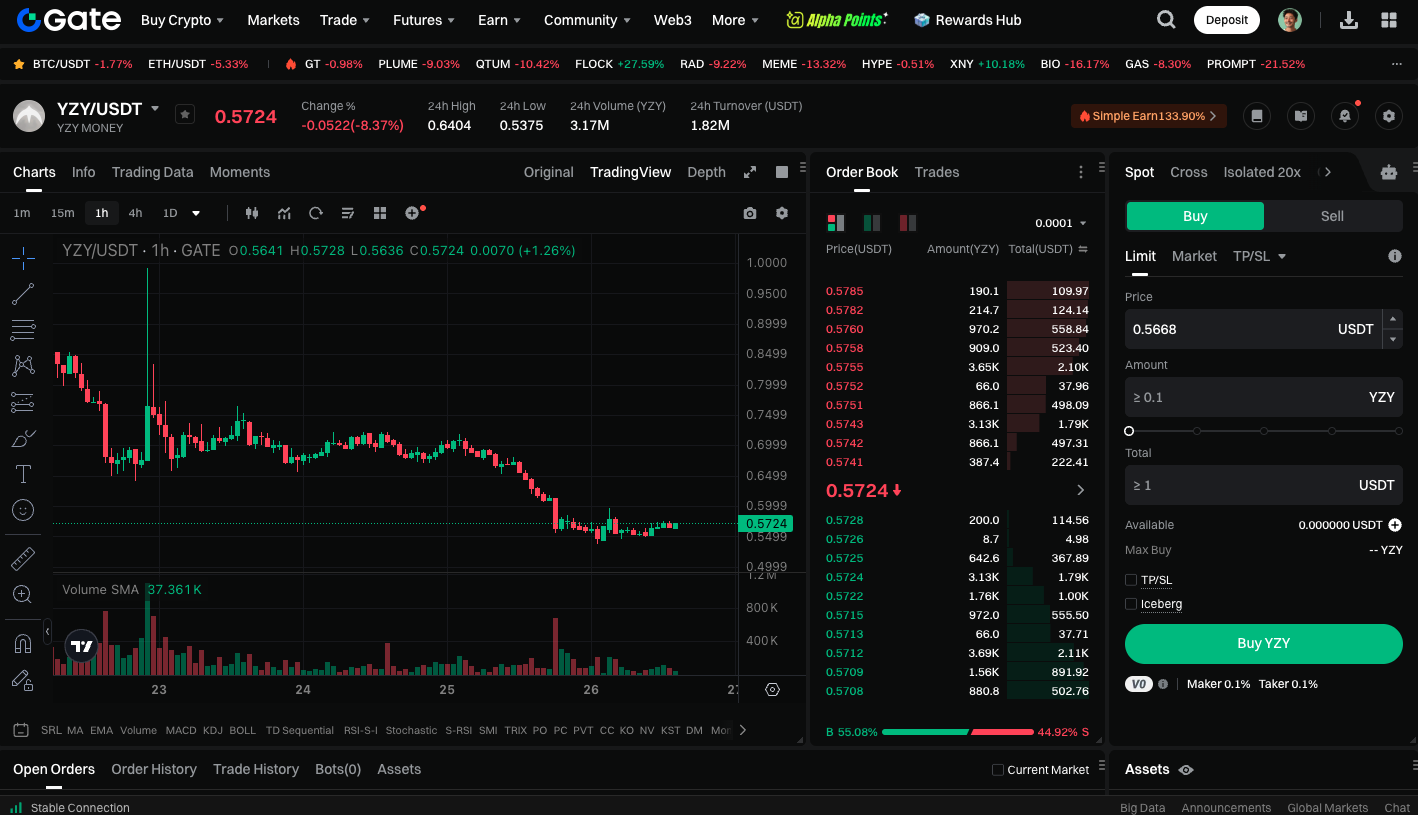

Kanye West, renowned for his impact on music and fashion, has now extended his reach into the blockchain sector. The launch of Kanye West Coin ($YZY) generated enormous market buzz, drawing billions of dollars in capital at its peak. Yet, this meme-inspired financial experiment, amplified by celebrity allure, quickly revealed significant risks.

Unilateral Liquidity

Unlike most mainstream tokens, which typically form trading pairs with USDC or other stablecoins, the $YZY liquidity pool consists exclusively of its own token. This setup enables the project team to adjust market prices by adding or removing liquidity, creating an implicit leverage effect. For retail investors, this structure lacks a price stabilization mechanism—if liquidity is withdrawn, the token price can become extremely volatile. Historical precedents indicate that such models often result in losses for the majority of small investors.

Controversial Practices and On-Chain Uncertainties

It’s not just the liquidity design that’s under scrutiny—on-chain data reveals several suspicious activities:

- Certain wallets gained early access before the official public launch, acquiring over one million $YZY for approximately $450,000 and cashing out within hours for a profit exceeding $1.5 million.

- This pattern of rapid, high-value arbitrage closely mirrors DeFi insider trading cases previously examined by regulatory bodies.

- On the day $YZY surged in popularity, tens of millions of dollars tied to the Libra controversy were released by the courts, fueling speculation that these funds may have flowed into the new project.

These indicators have intensified market suspicion regarding possible manipulation behind celebrity tokens.

Token Distribution

While the project claims $YZY is designed as a brand token for the public, real distribution figures paint a different picture: insiders control 94% of the total supply, with 87% held in multi-signature wallets. This high level of concentration undermines the notion of decentralization and leaves price movements vulnerable to control by a small group.

The Celebrity Token Dilemma

Kanye West Coin highlights a core industry issue: when celebrity status merges with the crypto market, does it foster innovation or drive speculation? On one hand, YZY showcases the potential for brand financialization, linking music, fashion, and blockchain payments. On the other, concerns over price manipulation, insider trading, and concentrated holdings make it seem more like a speculative venture than a genuinely decentralized financial ecosystem.

Start trading YZY spot now: https://www.gate.com/trade/YZY_USDT

Conclusion

The Kanye West Coin phenomenon underscores that celebrity tokens can rapidly capture attention but may fall short in creating sustainable value. Behind the flashy narratives and celebrity spotlight, investors must remain vigilant about structural risks. For the broader market, this episode could spark a deeper reconsideration of how cryptocurrencies intersect with mainstream culture.

Related Articles

Pi Coin Transaction Guide: How to Transfer to Gate.io

What is N2: An AI-Driven Layer 2 Solution

How to Sell Pi Coin: A Beginner's Guide

Grok AI, GrokCoin & Grok: the Hype and Reality

Flare Crypto Explained: What Is Flare Network and Why It Matters in 2025