Kanye West launches YZY MONEY (Yeezy Meme Coin): A crypto payment experiment powered by celebrity influence

Celebrities and Blockchain: Points of Intersection

(Source: YZY_MNY)

On August 21, 2025, Kanye West officially entered the cryptocurrency space by launching YZY MONEY and its native token, YZY, on the Solana blockchain. Leveraging Kanye’s massive star power, YZY’s market cap skyrocketed to over $3 billion in just 30 minutes before settling near $1.7 billion. This bold convergence of music and blockchain technology immediately drew widespread market attention.

Token Allocation and Potential Risks

According to the official website, YZY’s token distribution is as follows:

Public offering: 20%

Liquidity pool: 10%

Yeezy Investments LLC: 30%, locked for 3 months, then released linearly over 24 months

Team: 20%, locked for 6 months, then released linearly over 24 months

Ecosystem fund: 20%, locked for 12 months, then released linearly over 24 months

While long-term vesting is intended to support sustainable ecosystem development, the high allocation held by the team and institutional investors has raised concerns over token concentration and centralization risks.

Ye Pay: Delivering Low-Fee Payment Solutions

Launched alongside the YZY token, the Ye Pay payment solution promises transaction fees below the traditional 3.5% and is easy to integrate with e-commerce platforms and applications. Kanye’s official online store, yeezy.com, already accepts crypto payments. It will soon offer direct YZY payments, creating an integrated ecosystem for the brand.

YZY Card: Bridging Blockchain with Daily Life

Another standout feature is the YZY Card, which enables users to spend YZY or USDC at millions of merchants worldwide. Unlike standard crypto cards, the YZY Card is non-custodial, giving users full control over their assets. As the official card launch approaches, the waitlist is now open.

Market Doubts and Controversies

Despite the project’s celebrity backing, the market has tempered its enthusiasm. In its early phase, the liquidity pool initially consisted solely of YZY tokens, with no USDC pairing. This concentrated capital control in developer hands. Additionally, blockchain analysts found that certain suspected internal wallets acquired large amounts before the public launch and liquidated gains of millions of dollars in a short period, which fueled speculation of insider activity.

Key Takeaways for Investors

Industry experts highlight that approximately 94% of YZY tokens are currently held by insiders, mostly within a single multi-signature wallet. Although the team claims to have deployed 25 separate contract addresses to mitigate risk, investors continue to express doubts. Celebrity-driven projects naturally attract attention and discussion, but initial volatility and heightened risk are important for retail investors to consider.

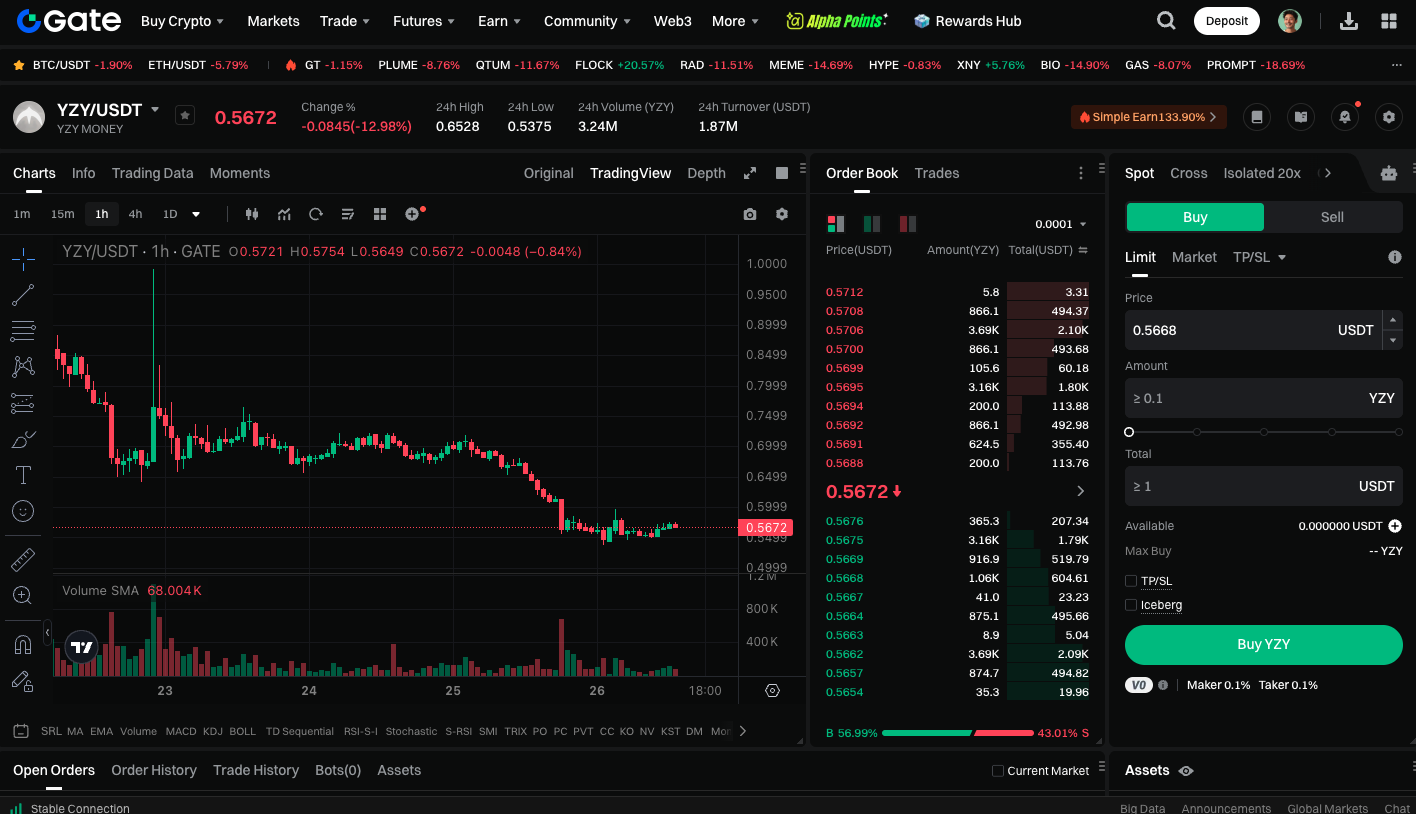

Start trading YZY spot now: https://www.gate.com/trade/YZY_USDT

Conclusion

YZY MONEY represents more than Kanye West’s entry into crypto—it’s an innovative experiment at the crossroads of music, fashion, and fintech. Its payment tools and practical use cases may drive mainstream crypto adoption. Stakeholders continue to question the transparency of its tokenomics and market practices. For investors, YZY MONEY is a high-profile project worth following closely, but it’s crucial to carefully evaluate the risks and not be swayed by celebrity hype or speculative short-term trends.

Related Articles

Pi Coin Transaction Guide: How to Transfer to Gate.io

What is N2: An AI-Driven Layer 2 Solution

How to Sell Pi Coin: A Beginner's Guide

Grok AI, GrokCoin & Grok: the Hype and Reality

Flare Crypto Explained: What Is Flare Network and Why It Matters in 2025