SatoshiClub

SatoshiClub

No content yet

- Reward

- like

- Comment

- Share

- Reward

- like

- Comment

- Share

- Reward

- like

- Comment

- Share

The UK’s FCA will soon allow retail investors to access crypto exchange-traded notes (cETNs) for the first time.

This marks a shift from the previous ban and brings the UK closer in line with the US, EU, and others.

Retail access will only apply to cETNs listed on FCA-approved exchanges.

This marks a shift from the previous ban and brings the UK closer in line with the US, EU, and others.

Retail access will only apply to cETNs listed on FCA-approved exchanges.

- Reward

- like

- Comment

- Share

- Reward

- like

- Comment

- Share

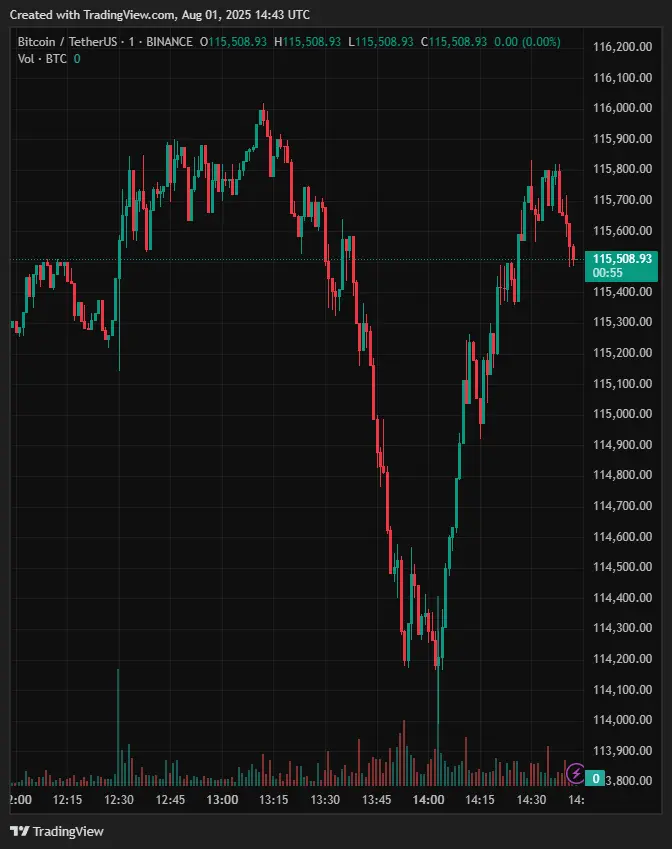

Bitcoin dropped to around $114,100 earlier this morning but quickly bounced back above $115,000.

Price is now holding near $115,160, showing signs of short-term recovery after a sharp dip.

Price is now holding near $115,160, showing signs of short-term recovery after a sharp dip.

BTC-2.09%

- Reward

- like

- Comment

- Share

- Reward

- like

- Comment

- Share

- Reward

- like

- Comment

- Share

We didn’t even expect spot Bitcoin ETFs to get approved so quickly just 2 years ago.

Now the SEC is launching “Project Crypto” - a new initiative to help modernize securities rules and support President Trump’s push to make the U.S. the crypto capital of the world.

The pivot is historic.

Now the SEC is launching “Project Crypto” - a new initiative to help modernize securities rules and support President Trump’s push to make the U.S. the crypto capital of the world.

The pivot is historic.

- Reward

- 1

- Comment

- Share

- Reward

- like

- Comment

- Share

- Reward

- like

- Comment

- Share

Jamie Dimon says JPMorgan “will have” a stablecoin.

The CEO of America’s biggest bank told CNBC that stablecoins could do things “traditional cash can’t,” adding, “It’s what the customer wants.”

Dimon has been critical of Bitcoin in the past, but this is a clear nod to crypto’s growing role in finance.

The CEO of America’s biggest bank told CNBC that stablecoins could do things “traditional cash can’t,” adding, “It’s what the customer wants.”

Dimon has been critical of Bitcoin in the past, but this is a clear nod to crypto’s growing role in finance.

- Reward

- like

- Comment

- Share

- Reward

- like

- Comment

- Share

- Reward

- like

- 1

- Share

Chishti92 :

:

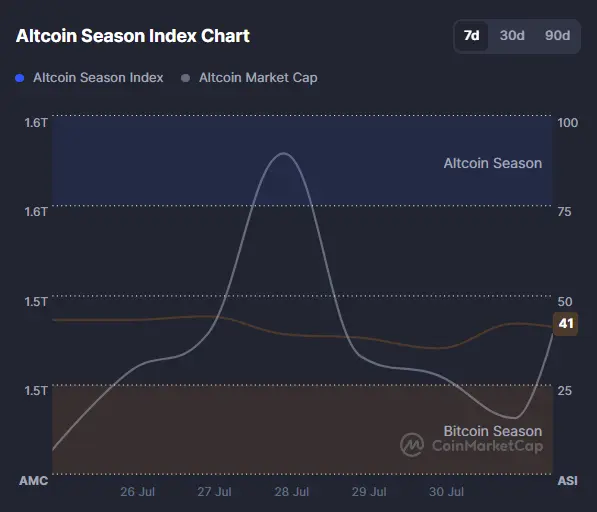

nice As of today, the Altcoin Season Index has climbed to 41, up from 35 the day before.

This means 41 out of the top 100 coins have outperformed Bitcoin over the past 90 days.

This means 41 out of the top 100 coins have outperformed Bitcoin over the past 90 days.

BTC-2.09%

- Reward

- like

- Comment

- Share

Satoshi Club has great jeans!

- Reward

- like

- Comment

- Share

- Reward

- like

- Comment

- Share

- Reward

- like

- Comment

- Share

- Reward

- like

- Comment

- Share

Goooooood morning to everyone whose bags are heavy! 🚀

- Reward

- like

- Comment

- Share